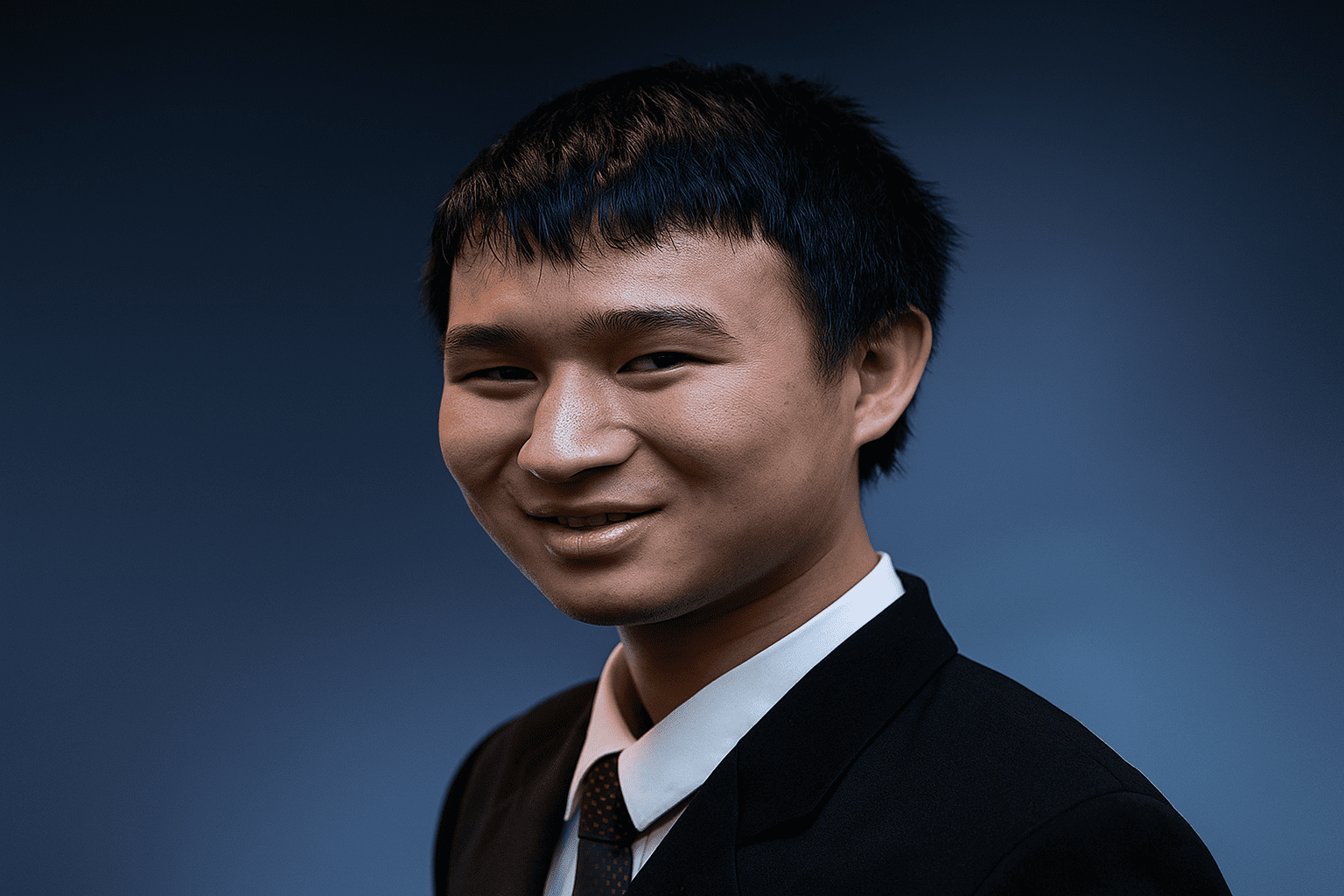

In the world of modern finance, where algorithms move billions in milliseconds, names like Patrick Chi stand out for their association with elite institutions and high-performance trading environments.

Patrick Minghao Chi is a quantitative trader at Citadel Securities LLC, one of the world’s most influential market-making and trading firms. While not a public figure in the conventional sense, Chi’s career trajectory embodies the rigorous blend of mathematics, programming, and decision-making that defines the top tier of quantitative finance today.

This article provides a fact-based, educational profile — verified through regulatory data and reputable reporting — about Patrick Chi’s career path, education, and key takeaways for students or professionals pursuing similar goals.

Early Education and Academic Foundations

Patrick Chi graduated from Columbia University, one of the Ivy League’s foremost institutions for applied mathematics and data science. His degree in Applied Mathematics laid the groundwork for the quantitative, analytical, and statistical skills required in market-making.

Why Applied Mathematics Matters in Quantitative Trading

Applied mathematics is the language of financial markets. Traders and quantitative analysts use it to model market microstructure, assess risk, and build pricing algorithms.

Some of the most essential mathematical domains in this context include:

-

Probability and statistics: To estimate market behavior, forecast volatility, and optimize execution.

-

Optimization and control theory: Used in portfolio allocation, hedging strategies, and order placement algorithms.

-

Stochastic calculus: Helps model random market movements and derivative pricing.

-

Linear algebra and numerical methods: Core to building models that operate efficiently in real-time systems.

For Patrick Chi, Columbia’s applied mathematics program provided the foundation for joining the highly competitive world of quantitative trading.

Joining Citadel Securities: The Start of a Trading Career

According to reputable financial career reporting (eFinancialCareers, 2022), Patrick Chi joined Citadel Securities in August 2020 immediately after graduating.

Citadel Securities is not just a trading firm — it is one of the largest market makers in the world, responsible for a significant share of U.S. equity and options trading volume.

As a trader within this environment, Chi operates in one of the most advanced, data-driven, and performance-intensive segments of global finance.

What Does a Citadel Securities Trader Actually Do?

At its core, a Citadel Securities trader’s job involves:

-

Providing liquidity: Quoting buy and sell prices across exchanges to maintain tight bid-ask spreads.

-

Managing inventory risk: Balancing positions across instruments and time horizons to minimize exposure.

-

Collaborating with quants and engineers: Building, testing, and refining trading models.

-

Analyzing performance data: Reviewing P&L drivers, latency metrics, and fill quality for continuous improvement.

Unlike traditional traders, quant traders operate in a world of microsecond decisions powered by algorithms and real-time analytics.

The Quantitative Edge: Tools and Technologies

While individual details about Patrick Chi’s daily workflow remain private, the broader practices of Citadel Securities’ trading teams are well documented.

Quant traders at the firm typically rely on:

-

Programming languages: Python, C++, and SQL for strategy development, analytics, and backtesting.

-

Data frameworks: Tools that process terabytes of tick data to identify patterns and anomalies.

-

Machine learning methods: To improve signal detection, price forecasting, and model robustness.

-

High-performance computing: Latency-sensitive infrastructure to ensure sub-millisecond execution speeds.

This combination of quantitative rigor and engineering precision defines Citadel Securities’ competitive edge — and by extension, the environment where Patrick Chi works.

FINRA Registration and Verified Employment

The Financial Industry Regulatory Authority (FINRA) — a U.S. self-regulatory body overseeing brokers and trading firms — lists Patrick M. (Minghao) Chi as a registered trader under Citadel Securities LLC.

This registration confirms:

-

Employment at Citadel Securities.

-

Active licenses for securities trading.

-

Registration across multiple U.S. exchanges, including FINRA, NYSE, Nasdaq, and Cboe.

This regulatory footprint validates his professional standing and role as a market professional in compliance with U.S. trading regulations.

(Source: FINRA BrokerCheck public record, 2025)

Life as a Trader at Citadel Securities

Trading at Citadel Securities combines speed, precision, and teamwork. While popular media often dramatizes trading as a solo sport, in practice, it’s a collaborative analytical discipline that merges quantitative reasoning with disciplined execution.

A Typical Day (Generalized View)

While Patrick Chi’s personal routine is private, traders in similar roles at Citadel Securities follow structured yet dynamic routines:

-

Morning prep (before markets open):

Reviewing overnight data, macro events, and pre-market order flow. Adjusting models and parameters accordingly. -

Active trading hours:

Monitoring algorithms, responding to anomalies, refining signals, and managing risk. Performance and latency are monitored in real-time. -

Post-market analysis:

Deep dives into what worked and what didn’t — analyzing fill ratios, market impact, and model accuracy. -

Collaboration sessions:

Traders, quantitative researchers, and engineers brainstorm improvements and new approaches for the next trading cycle.

This combination of routine and continuous innovation forms the backbone of elite trading culture.

Citadel Securities: The Broader Context

Understanding Patrick Chi’s role also requires understanding Citadel Securities’ position in the financial ecosystem.

A Global Market Maker

Founded in 2002 as part of Ken Griffin’s Citadel enterprise, Citadel Securities has evolved into a global liquidity provider, executing trades for retail brokers, hedge funds, and institutional clients.

Key facts (as of 2025):

-

Citadel Securities accounts for over 25% of U.S. retail equity volume.

-

The firm operates in more than 50 countries, with major offices in New York, Chicago, London, Hong Kong, and Singapore.

-

It plays a central role in price discovery, ensuring that markets remain efficient and liquid.

Working within such an organization places traders like Patrick Chi at the intersection of data science, regulation, and global finance.

Skill Set Breakdown: What Defines a Quant Trader Like Patrick Chi

To operate effectively in Chi’s role, a trader must integrate multiple skill domains.

1. Mathematical Fluency

Quant traders must translate real-world market behavior into mathematical form. This means:

-

Calculating probabilities and expected values.

-

Modeling volatility and correlation structures.

-

Applying optimization to manage position sizing.

2. Programming Proficiency

Code is the medium of execution. Skills typically include:

-

Python: For data analysis and prototyping models.

-

C++: For low-latency production systems.

-

SQL: For querying and structuring trade and tick data.

3. Data Science and Machine Learning

Modern trading involves pattern recognition and anomaly detection using ML tools such as gradient boosting or reinforcement learning.

4. Market Microstructure Knowledge

Understanding how orders interact in the market is key. Concepts like spread capture, latency arbitrage, and limit order dynamics are central to decision-making.

5. Emotional Discipline and Risk Control

Even the most quantitative roles require composure under pressure. Traders like Chi must manage real-time uncertainty with probabilistic confidence — balancing mathematical conviction against live market feedback.

Lessons from Patrick Chi’s Career Path

Though the public record on Patrick Chi is concise, his trajectory offers valuable lessons for aspiring quantitative professionals.

1. Build Technical Depth Early

Chi’s transition from a mathematics degree directly to Citadel Securities shows how academic rigor translates to market relevance. Students should focus not just on grades but on applying math to real-world systems — simulations, trading games, or research projects.

2. Learn to Code as a Mathematician

Programming is not optional in modern finance. The ability to translate formulas into functioning code is a differentiator between theory and execution.

3. Seek Internships or Research Exposure

Citadel Securities and similar firms often recruit through technical assessments and internship programs. Exposure to live market data or applied projects demonstrates readiness.

4. Think in Risk, Not in Returns

Professional traders prioritize risk-adjusted outcomes, not absolute wins. The key is not predicting perfectly but controlling exposure through mathematical frameworks.

5. Understand Compliance and Licensing

As demonstrated by Chi’s FINRA registration, professional traders must maintain active licenses and uphold regulatory standards. This professionalism distinguishes institutional traders from retail or hobbyist participants.

The Modern Trader’s Toolbox

Professionals in Chi’s environment rely on sophisticated systems, but the principles are universal.

| Category | Tools & Practices |

|---|---|

| Analytics | Python (pandas, NumPy), R, SQL, Jupyter notebooks |

| Modeling | Statistical inference, Monte Carlo, time series, ML frameworks |

| Execution | Low-latency C++ engines, real-time monitoring |

| Risk | VaR, expected shortfall, stress testing |

| Communication | Data visualization, dashboards, post-trade reports |

This synthesis of analytics, automation, and disciplined review creates compounding expertise — the hallmark of elite trading desks like Citadel’s.

The Culture of Quantitative Finance

Citadel Securities’ success — and by extension, Chi’s environment — depends on a meritocratic, data-driven culture.

Key Characteristics of That Culture:

-

Transparency: Data trumps hierarchy; decisions are debated through results.

-

Iteration: Strategies evolve rapidly, with measurable testing cycles.

-

Cross-discipline collaboration: Traders, researchers, and engineers function as integrated teams.

-

Performance measurement: Every improvement is benchmarked, analyzed, and refined.

For young professionals, understanding this culture helps set realistic expectations about the pace, pressure, and intellectual rigor of high-frequency finance.

How to Follow a Similar Path

If you’re inspired by Patrick Chi’s trajectory, consider these steps to build your own foundation in quantitative trading:

-

Academic Focus:

Pursue degrees in mathematics, computer science, physics, or statistics. Courses in stochastic processes, optimization, and financial engineering are particularly relevant. -

Technical Projects:

Build your own market simulator or backtesting framework. Document your code and logic — it demonstrates both understanding and initiative. -

Internships:

Apply to structured programs at Citadel, Jane Street, Jump Trading, or Optiver. These offer exposure to real markets and mentorship from professionals. -

Certifications & Licensing:

For U.S.-based trading, expect to obtain Series 57 or 7 licenses through FINRA — a step traders like Chi have completed. -

Continuous Learning:

Stay current with new quantitative methods, AI advances in finance, and regulatory developments. The landscape evolves yearly.

Ethical and Professional Standards

Quantitative trading is not purely mathematical; it’s also moral and regulatory.

Professionals like Patrick Chi operate under strict ethical codes to ensure:

-

Fair market access (no manipulation or data misuse).

-

Transparency in algorithmic execution.

-

Compliance with global and local trading laws.

-

Confidentiality regarding firm data and client information.

Citadel Securities, like all major trading firms, enforces robust internal compliance programs — reinforcing the importance of professionalism alongside performance.

Broader Impact: Quant Traders in the Global Market

Market makers like Citadel Securities play a crucial role in market efficiency. By constantly quoting buy and sell prices, they narrow spreads, improve liquidity, and stabilize volatility.

Traders such as Patrick Chi thus indirectly contribute to the functioning of global capital markets — ensuring that retail investors, pension funds, and institutions can trade smoothly and fairly.

This systemic importance makes quantitative trading not just a high-income profession but also one of public significance.

Frequently Asked Questions

Q: Is Patrick Chi a public figure?

No. Patrick M. (Minghao) Chi is a professional trader at Citadel Securities. While publicly registered, he is not a celebrity or public spokesperson.

Q: What’s verified about his background?

-

Employed at Citadel Securities (via FINRA BrokerCheck).

-

Columbia University graduate in Applied Mathematics.

-

Joined Citadel Securities in August 2020 (via career reporting).

Q: What are the best degrees for a similar career?

Applied mathematics, computer science, physics, and quantitative finance are top choices.

Q: Do you need a license to trade professionally?

Yes. In the U.S., traders require FINRA registration and exams such as Series 57 or 7.

Q: Can anyone enter quantitative trading?

With the right technical and analytical background, yes. However, the competition is intense, and firms hire only top percentile performers.

Conclusion: Patrick Chi’s Story as a Modern Blueprint

Patrick Chi’s professional path — from Columbia University to Citadel Securities — offers a clear modern blueprint for aspiring quants. It demonstrates how academic depth, technical mastery, and discipline under uncertainty combine to create success in algorithmic finance.

His verified record reflects not celebrity, but professional excellence in one of the world’s most competitive industries.

For readers inspired by Chi’s trajectory, the path forward lies in cultivating the same attributes: curiosity, precision, and relentless improvement.

Because in markets — as in mathematics — the details make the difference.